Research objectives

to determine the profitability of micro finance institution

Determine the components, purpose, and relevance of important financial statements, as well as the links between them.

Present the income statement and balance sheet in such a way that the impact of donor resources is evident.

Track profitability, balance sheet management, portfolio quality, efficiency, and productivity by analysing financial statements.

Calculate the expenses of resources obtained through market transactions, the conversion of savings, or the receipt of subsidies and contributions.

Examine the provisioning and determine the rates used to cover doubtful debts and write-offs.

Create a global financial diagnostic that incorporates the microfinance institution’s investment policy, financing policy, and treasury.

Determine the aspects that are critical to progressing towards profitability and financial sustainability.

to determine the impact of net income total assets on net income to

total operating expenses

Profit after taxes is known as net income and is obtained from the company’s income statement. The assets are taken from the balance sheet and consist of cash and cash-equivalent things like receivables, inventory, land, capital equipment that has been depreciated, and the value of intellectual property like patents. The assets also include cash and cash-equivalent goods like land.

The amount a firm has made from its core activities is represented by the profitability metric known as net operating income (NOI), which is determined by subtracting operating expenditures from operating revenue. It does not include non-operating costs like interest, tax charges, loss on the sale of a capital asset, etc.

To know the impact of financial performance on financial sustainability

According to the study, there is a positive association between financial performance and financial sustainability corporate as evaluated by earnings yield, return on asset, return on equity, and return on capital employed. When it comes to a market-based financial metric.

The earning yield

It may be used to compare the profits of a certain stock sector or the entire market to bond rates. In general, stocks have a greater profits yield than risk- free treasury bonds. Some of this may be distributed as dividends, while others may be preserved as retained profits. Stock market prices can rise or fall, reflecting the added risk associated with equity transactions.

Return on asset

Return on assets is a measure that shows how profitable a firm is in comparison to its total assets. Management, analysts, and investors can use ROA to analyse if a company’s assets are being used efficiently to make a profit. Divide a company’s net income by its total assets to get its ROA.

return on equity

An economic concept known as return on equity, which is both extremely ancient and hotly debated, calculates the proportion of net profit to equity contributed by partners or shareholders of businesses.

Return capital employed

Return on capital employed (ROCE) is a financial measure that may be used to evaluate the profitability and capital efficiency of an organisation. In other words, this ratio may be used to determine how well a business is turning a profit from the capital it uses.

to know the impact of various financial ratios on financial performance

Financial ratios can provide insight into a company’s financial situation. A business’ debt, inventory, and sales health can be assessed depending on the ratio and the part of the firm being analysed. Liquidity ratios, for instance, demonstrate how well a company fulfils its short-term financial obligations.

Inventory turnover and days inventory are two financial measures that may help a corporation manage its inventory flow. Inventory turnover is a measure of how rapidly a company sells its inventory. It is also a useful tool for assessing obsolescence and tracking both over and under-performing items.

Days inventory is a measure of how long it takes a company to go through its inventory. This ratio can also reveal which goods are selling well and which are not.

Financial ratios may assist a company in determining its profitability. The gross profit margin is one example. This metric reflects how successfully a corporation earns profit before deducting general operating and inventory expenditures. The net profit margin reveals if a company’s revenues are sufficient to cover its operational expenses while still turning a profit. Return on Investment is a measuring tool that both present and prospective investors are interested in. This ratio demonstrates how successfully money invested in the firm has been used.

Conceptual Framework

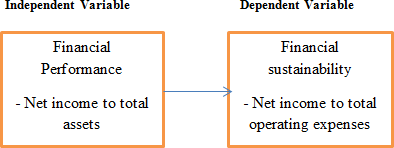

The term «conceptual framework» refers to a model that is hypothesised and describes the link between the dependent and independent variables. A conceptual framework’s objective is to draw links between and categorise significant concepts for the investigation. Researchers might map the study area or conceptual scope, systematise relationships between concepts, and uncover literature gaps with the use of such a framework. The dependent variable in this study is the financial sustainability of microfinance organisations, whereas the independent variable is financial performance. The link is well seen in the image below.

Conceptual framework 1

Review of Variables

In the following, we are talking about conceptual framework variables with precise examples.

Financial Performance

Profitability and Return on Assets are two metrics used to assess a microfinance institution’s financial success. However, profitability ratios are crucial to managers and owners as they are utilised to calculate the financial institution’s bottom line (Gorton, 2012). Gorton (2012) and Schreiner (2013) assert that while analysing managerial entrenchment and takeovers in Latin America, they concentrated on accounting indicators of profitability.

According to Barclay (2012), profitability holds up to a modest degree. According to persistence, there may not be many significant deviations from fully competitive market arrangements. The analysis also demonstrates that, with the exception of size, all particular factors have the expected effects on performance (Barclay, 2010). Profitability and financial sustainability have a positive correlation, according to a research by Ongaki (2012) that looked at the factors affecting deposit-taking Microfinance institution in Africa.

Nafé Daba (Central Bank of West African States, BCEAO) examines the bank-microfinance interaction and Central African access to funding using panel data from five countries from 2000 to 2018. He argues that microcredit, credit banking interaction, and investment are all complementing causes of economic growth.

Lassiné Bamba (Ivory Coast) devotes a sociological case study to the micro-savings and the problem of access to health coverage for craftsmen in

Ivory Coast. It traces the context, history and performance health care coverage

implemented by a non-profit mutual insurance company (non-governmental organization, NGO) for the benefit of artisans informal. He emphasizes that the success of the experiment depends.

As a jurist, Jean Issa Bala (Cameroon) asks if the Commission should move beyond (the regulation) of diverse microfinance services like as micro insurance and mobile banking platforms. Central African banking. We deplore the lack of a true comparison between regulation and non-regulation, as well as the profusion of notes and old references.

Patrick Mbouombouo Mfossa (Congo) investigates tontine practises in the digital era. These are distinguished by the usage of cell phones and electronic money: software controls tontine meetings and electronic money.

Record transactions without the actual presence of members tontines. A case study describes how a tontine of 25 members works in conjunction with participatory finance (crowdfunding), which mobilises non-members on the web and therefore widens the market for monies loanable. Members behaviours include various motivations: financial profitability for the lender, savings retention, and access to credit for the borrower.

Lawani (Benin) investigates the factors that influence labour mobility in microfinance institutions. The review of literature focuses on human capital theory, matching, labour market segmentation, and job seeking.

Todaro fashion. This final model is evaluated using a probit on a sample of 144 microfinance institutions employees observed in Benin between 2012 and 2014. It turns out that pay differences are a key, but not the only, cause for movement, which is influenced by human capital, seniority, marital status, and bonus.

Profits are positively connected with business cycle movements, according to a study by Gregoire and Tuya (2016). Berger and Mester (2015) conducted

research on the profit structure connection in Australian banking, offering tests of profitability on the financial sustainability of microfinance firms. The relative market power theory was partially validated since there was evidence that reducing operational risks increased earnings. The efficient structure hypothesis, on the other hand, was determined to have weak support. It was argued that efficiency not only increases profits, but it may also lead to market share gains and therefore increased concentration, so the discovery of a positive association between concentration and profits could be a false conclusion due to correlations with other factors.

Muriu (2011) discovered a positive association between profitability and financial sustainability of microfinance institutions in his study on the factors of financial sustainability of deposit taking microfinance institutions. As a result, increased profitability leads to increased financial sustainability.

Financial Sustainability of Microfinance Institutions

The ability of a microfinance institution to pay all of its expenditures through interest and other income received by its clients is referred to as financial sustainability (Consultative group, 2012). Microfinance institutions are increasingly more concerned about long-term financial viability. International foundations and funders have recognised that well operated microfinance institution can pay a considerable percentage of their expenditures and have demanded that they achieve an increasing level of self-sufficiency.

Financial self-sufficiency, according to Woller (2010), is a non-profit equal of profitability. Kinde (2012) also stated that the poor required long-term access to financial services rather than just one-time financial assistance. Meyer further claimed that financial insecurity is caused by a poor payback rate or the non- materialization of cash promised by donors.

The limited empirical research on the performance and sustainability of microfinance yields conflicting results. For example, according to Namibian

research, practically all microfinance is not sustainable (Forbes, 2010). The study looked at institutional leverage, profitability, and outreach as significant factors of microfinance institution financial sustainability. According to a research on Nepal microfinance, the majority of rural microfinance institutions are not sustainable (Acharya, 2015). This study looked at operating expenses, profitability, and business risk as factors of microfinance institution financial sustainability. Because the study intends to uncover factors of financial sustainability of microfinance organisations, financial self-sufficiency will be employed as a dependent variable in this study.