What is Microfinance? theoretical Frame, characteristics, evolution and limitations

2.2 What is Microfinance?

2.3.1 Definition and Characteristics

Microfinance as defined by Steel et al (2004) refers to small financial transactions with low-income households and micro enterprises (both urban and rural) using non-standard methodologies such as character-based lending, group guarantees and short-term repeat loans.

Fernando (2006) also emphasized that what makes the microfinance scheme a “noble” approach is that in an attempt to reach out to more people; it can commercially maximize profits to support these objectives.

This means, as a company, it has the potential to facilitate a core objective of being financially self financially self sufficient and at the same time deliver to the larger market in mostly focusing on their customer.

Traditionally, commercial banks have provided financial services to customers with little or no cash income. Banks must incur substantial cost to manage a client account, regardless of how small the sums of money involved.

In a broader framework, it has long been accepted that the development of a healthy national system is an important goal and catalyst for the broader goal of national economic development..

Because of these difficulties, when the poor borrow they often rely on relatives or a local moneylender, whose interest rates can be very high.).

Although much progress has been made, the problem has not been solved yet, and the overwhelming majority of people who earn less than $1 a day, especially in the rural areas, continue to have no practical access to formal sector finance.

Microfinance has been rapidly growing with $25B currently at work in microfinance loans (Deutsche Bank, 2007).

2.3.2 Evolution in Microfinance Industry

The microfinance sector is changing quickly. MFIs are developing from social lending programmes into sophisticated banking operations.

So far, regardless of whether growth occurs organically, as a result of consolidation, or through acquisition, financial institutions must be ready to support their businesses as they expand and deepen.

To gain competitive advantage, these organizations such as MFIs must use technology effectively.

Microfinance institutions aim to have a positive impact on the life of the poor. It does not only mean poverty alleviation; it should as well indicate poverty reduction (in case of no poverty).

Therefore, to maximize their positive impact, MFIs should have both breadth and depth of outreach (Chua, 2005).

To do so MFIs should be financially and institutionally sustainable in being able to continue to provide services in the future in mostly covering their costs of operations from the revenues they generate for offering their services.

However, they must have the ability to develop and retain its people, for “people run organizations” (Chua, 2005).

In recent years, the landscape of the microfinance market has changed dramatically. Some institutions have therefore become formalized financial institutions.

And they have been forced to focus on improving efficiency by retaining clients and identifying new clients interested in the financial services offered..

According to William Grant (2000), all microfinance providers, whether they are nongovernmental organizations (NGOs) with focus on poverty lending or for-profit commercial institutions concerned with maximizing their return on investment, realize that the existence of a strong and permanent institution is crucial in ensuring the successful provision of microfinance services.

Furthermore, Microfinance institutions can be also analysed as businesses, asking how some MFIs succeed in reducing and covering costs, earning returns, attracting capital, and scaling up.

The author is interested in self-sufficient MFIs or merely operationally self-sufficient, and on commercial success because viewing MFIs as practical solutions to challenging business problems is a suitable place to start by understanding the reason why most microfinance operates in the ways it does.

According to Roodman and Qureshi (2006), “although the capacity of the poor to borrow and save is counterintuitive for some people, their need to do so is actually greater than better-off people.

Precisely because their incomes are tight, and often volatile, financial services that help them fill in mismatches between income and consumption needs can be a matter of survival.”

However, lending and savings could help households manage these mismatches and help them accumulating capital for investment as well.

In fact, microfinance gets its own market, but MFIs should push costs below revenues, or bring them close enough that the need for subsidy is not a barrier to growth.

To do so, some tough business challenges must be faced in building volume, keeping loan repayment rates high, retaining customers, and maximizing scope in branches.

2.3.3 Microfinance in Cameroon

To meet unsatisfied demand for financial services, a variety of MFIs has emerged over time in Africa.

Some of these institutions only focus on providing credit, others are engaged in providing both deposit and credit facilities, and some are involved only in deposit collection.

A range of institutions provide financial services to low-and medium-income people in the CEMAC region (including Cameroon), including licensed microfinance service providers, mainstream financial institutions such as commercial banks and money transfer companies, non-bank providers including postal networks, and unlicensed service providers and informal groups as savings clubs.

Access to finance in the CEMAC region is among the lowest in the world (Technical Note Report, 2006).

Banks manage one million accounts (estimated at 3 percent of total population) and MFIs serve 780,000 clients (estimated at 2.2 percent of total population).

Several factors might contribute to the low levels of access. Interest rate controls discourage banks form mobilizing greater deposits and taking greater risks in expanding their lending portfolio.

Regional monetary policy has led to excess liquidity in banks, further eroding their interest in expanding access and mobilizing more deposits.

Low population density (11.5 inhabitants per square kilometre compared to 22 inhabitants per square kilometre for WAEMU region) and low purchasing power lead to higher operational costs for MFIs and other institutions that serve a broader range of clients.

Finally, a lack of credit information on potential borrowers and a poor legal environment discourage financial institutions from expanding their client base (figure.2.11 below).

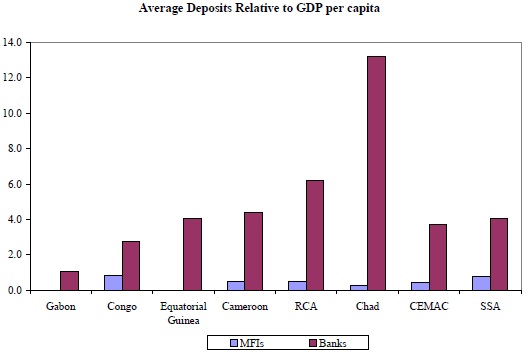

Figure.2.14: Average Deposit Relative to GDP per capita in the CEMAC region.

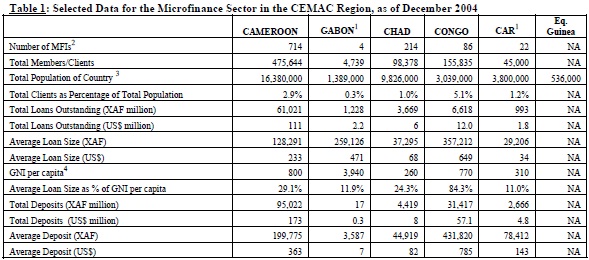

The microfinance sector in the CEMAC zone has experienced impressive growth in recent years.

In 2001, COBAC commissioned the first regional survey and identified 908 MFIs serving 413,500 clients with 53.8 billion XAF in deposits and 29.4 billion in outstanding loans.

As of December 2005, the estimated 1,022 MFIs have grown to serve approximately 780,000 customers with 133 billion XAF in deposits and 73.5 billion XAF in outstanding loans (see table 2.1 below).

Table 2.3: (From COBAC and Data collected during the FSAP Mission)

Access to finance remains low and uneven across the CEMAC zone.

In terms of number of MFIs and volume of deposits and loans, the microfinance sector is most developed in Cameroon followed by Chad and Congo.

Microfinance is moderately developed in CAR and was seriously affected by civil war. MFIs are only emerging in Gabon and Equatorial Guinea.

In Cameroon, mostly, points of services are mixed across urban and rural areas.

The question to be answered is to know how a Cameroon can maintain its expansive outreach and sustainability by providing responding services to target customers (microenterprises and low-income people).

The continuing challenge for MFIs is how to push the frontiers of microfinance industry such that more of the poor are provided with responsive financial services in a sustainable manner.

Meeting this goal requires to go beyond the tried and tested services currently available, and effectively multiply efforts in a bid to attract and retain the existing customer as the poor.

2.4 Limitations and Gaps

Despite the renown of CRM, there have been different views as to how companies perceive the right definition to be.

The limitation which has lead to various researchers to rise the challenge and face it so as to address a certain couple of problems linked to CRM implementation that have proved elusive.

Relating to the definition of existing and potential benefit of CRM initiative according to Xu et al (2002), CRM approach improves organizations abilities to understand the current needs of their customer, their previous behaviour in the past, and how they are going to behave in the future.

Thus, it is noticed that the benefit (s) firms will gain from CRM is no small deal.

Other research literatures such as Hart et al (2004), Kennedy and King (2004), Tellefsen and Thomas (2005) support the Xu et al’s view on the positive impact of CRM on firms.

However, others researchers namely Abdullah et al (2000), Jutla et al (2001) have tried to find the critical success factors for CRM implementation but only of them could produce supportive evidence for those critical success factors (Riyad, 2007).

2.5 Theoretical Frame of Reference

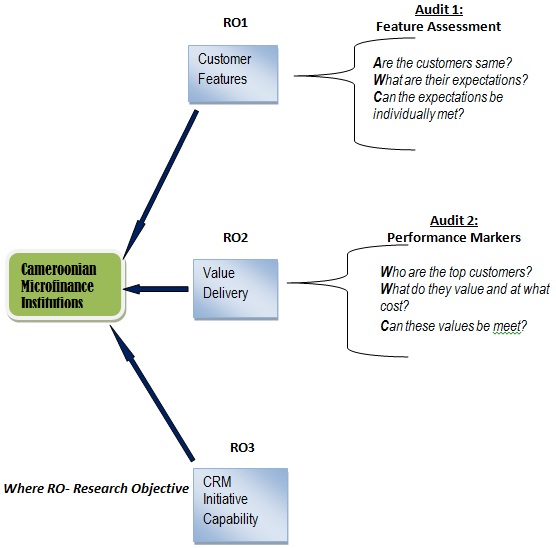

To build up a frame of reference, the author intends to analyze each research question, and give a summary of how the knowledge acquired from the literature review was used to ensure a sense of focus and in which path the research will stress on.

2.5.1 How well are the customers segments understood and individually serviced?

The above question is related to first objective of the report namely “to appraise the current level of CRM usage in Cameroon MFIs”.

The author intends to look how CRM tool might differentiate the customers in segmenting and for a personalizing the service, that is breaking down into various categories, and market the services and products to each category so that they may be differentiated and targeted to the nature of the market.

Marwan (2008) stated that segmenting is the division of the customer base, or potential consumer base into categories where there are similar characteristics.

However, in a case where the knowledge of customers’ needs is misunderstood, it could result in the company losing a customer loyalty to its competitor who can rightly meet the customers’ needs.

According to Wilson (2008), there are various areas of possible customer expectation placed into 5 categories such as: ideal expectation or desires, normative “should expectations, experience-based norms, acceptable expectations, and minimum tolerable expectations.

He explains therefore that levels of expectation are why two organizations in the same business can offer different levels of services and still keep customer happy.

Kathleen (2000), from the different levels of customers expectations defined by Wilson above, gave the “customer service sensitivity scorecard expectation checklist” which can be used to evaluate how well to understand and service different customers segments.

The scorecard contains the following questions:

- Do you know what percentage of your customers you keep each year?

- Do you know what percentage of your customer you lose each year?

- Do you know the top three reasons your customer leave?

- Do you know what your customer’s number-one expectations are?

- In the last three, have you personally contacted at least ten former customers to find out why they defected?

- In the last six months, have you checked to see if any of your customers’ expectations have changed?

- Do you know how any members or your staffs serve internal or external customers?

- Is any of your customer service performance standards tied to incentive program?

It should be noted that while right marketing may dissatisfy customer, only great customer care, consistent communication, and constant product or service improvement will pull customers back always.

2.5.2 What relevance will CRM tool offer the Management towards value delivery that can create loyalty and satisfaction?

The above question, that dealing with the second research objective which is “to access how CRM use can deliver an effective customer value” aims at determining a qualitative value delivery in which a firm can provide for its customers so as to facilitate their loyalty and satisfaction.

The Pareto principle (namely the 80-20 rule) stating that the top 20 percent (20%) of a firm’s customers account for 80 percent (80%) of its profit shows its importance for companies to ensure the delivery value towards creating customer loyalty and satisfaction.

Thus, satisfaction is a post-purchase evaluation of products or services quality given pre-purchase expectations exceeds experience, one is satisfied; but when expectations exceed experience, one is dissatisfied (Baran et al, 2008).

Anderson Formell and Marzancheryl (2004) focussed on satisfaction as a performance metric associated with CRM success.

Satisfaction can positively affect other performance metrics such as retention, “share-of-wallet”, and shareholder value.

Earlier, Boulding et al (1993) divided customer satisfaction into two folds such as Transaction-specific customer satisfaction or Cumulative customer satisfaction.

The former (Transaction-specific) is taken as the customer’s post-choice evaluative judgement of a specific purchase occasion.

The later (Cumulative) is the customer’s overall evaluation of the accumulated customer experience.

Thus, irrespective of the way the company seeks to evaluate the customer’s satisfaction on their services or products, it is clear that every point of the relationship co-existing either between company-loyal customer, company-prospect, given the customer a value for their money and that which could take over their expectations vital to the level of loyalty the company will derive from its customers and this may determine whether they keep leading them or look for their competitors who can be sensitive to their needs.

On the other hand, IDM (2002) used a “Ten Steps Strategic Framework” to show companies can drive their CRM strategy towards ensuring that customer loyalty and satisfaction is initiated and sustained throughout their relationship life-span, such as:

- Investment: invest according to customer value

- Relationship: optimize the whole customer relationship

- Reputation: be trustworthy in ethics and brand values

- Relevance: service each customer community appropriately

- Value: create enduring value first, tactical worth secondly

- Touch-points: manage the relationship at all appropriate touch-points

- Imagination: bring imagination to the customer experience

- Learning: measure and learn

- Technology: use technology smartly and skilfully

- Stakeholders: make it for everyone.

Yet, technology is placed towards the bottom of the above list.

For CRM should be taken as a business-objective and strategy-oriented instead of as a technology.

Therefore, technology should act as a enabler.

To put it bluntly, CRM tool should help answer the following questions:

- Which customers are most valuable?

- Can the customer service experience be enhanced and sustained?

- How can we deliver personalized value that created loyalty?

- How can we get customer information that can enable us to identify the various types of customers so as to treat them separately?

2.5.3 Can CRM be implementable in Cameroon MFIs in order to produce appropriate results?

The above question deals with the Cameroonian “culture” in how they perceive things to be.

It sometimes tough for others to be familiar with Cameroonian system because something which could be achieved somewhere else might not easily applicable in Cameroon due to some factors such as:

Government policy towards development, basic social amenities and infrastructures, ethics (corruption), quality of education, computer usage and awareness ratio, technology development, social-cultural factors.

Having studied various CRM frameworks by Forrester research, Dasai et al, and Payne and Frow, it was identified four basic elements which a CRM framework should contain (Strategy, Process, Technology and People).

Each of them will be considered in the overall one that will proposed in the further artefact.

In order to determine which of these frameworks can be implementable, the author will carry out the following audit:

2.6 Emerged Frame of Reference

The market dynamics facing microfinance services companies in Cameroon have never been more fluid and complex.

Customers are in the midst of these trends (Russ, 2006).

With intensifying competition threatening MFIs’ revenues and putting downward pressure on operating margins and profits, MFIs are facing increasing pressure to increase their growth rate.

In plus, customers in the CRM microfinance industry could rate far more favourably than those in the non-CRM which is an indicator of the superior level of services in the former.

This could be attributed to CRM.

Furthermore, there does not appear any major difference in perception among the individual and organizational customers, except for a relatively lower rating by the latter which might suggest that they come forth with higher expectations.

However, since the difference is not significant, it may not be noteworthy in terms of organizational strategy, on the part of Cameroon’s MFIs management.

Also, there is a direct relationship between perception and satisfaction, commitment and loyalty which underlines the significance of CRM in service industry.

The emerged frame of reference for this research is shown in below figure. Subsequent chapters will be lead by this reference frame.

Cameroonian Microfinance Institutions

Customer Features

Audit 1:

Feature Assessment

Are the customers same?

What are their expectations?

Can the expectations be individually met?

Value

Delivery

Audit 2:

Performance Markers

Who are the top customers?

What do they value and at what cost?

Can these values be meet?

CRM Initiative Capability

Where RO- Research Objective

Figure 2.15. Emerged Frame of Reference